Health and Lifestyle – Deep Thoughts on the ‘WHY?’ of the Human Condition

Work Life Balance

I grew up on a farm and in a small town in Wisconsin. The life was simple, creative and the work was hard. There is something about working with my back instead of my brain that I miss and that I enjoy. Lately, I’ve been called back to that life. I’m working hard to bring that experience back to my family…whether they like it or not! For those of you that haven’t experienced a life on a farm, HERE‘s a great blog that explains the hard work and amazing rewards of farm life.

Slowly but surely I hope to build a barn, small home and raise cattle in Patagonia, Arizona. The region is called the Sky Islands and it’s rich with birds, wildlife, and ranching. Our property is full of 100+ year oak trees and it’s nestled in a valley surrounded by red rocks.

On being an authentic man…..

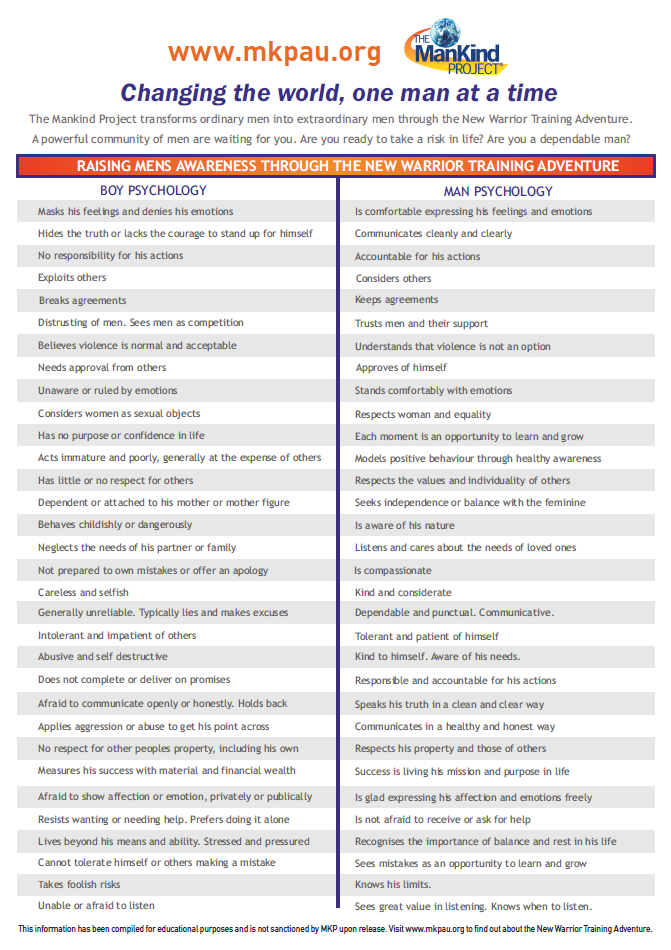

I love what I do and who I work with. Balancing work life, family life and fun is a constant challenge. I’ve had a transformation journey that opened my eyes to motivates me and began the journey of discovery as to who I am. During my soul searching, I learned that I’m responsible for how I show up, ultimate accountability, life-long learning, and faith is my path to peace. In order for me to be effective as a father, husband and business leader I have to constantly be working on me. Sadly, many men in society are broken. I believe that is broken and the ability to learn about what makes people tick is a unique part of the human condition. The scars of life are typically imprinted in our family of origin. As ideal as my family was there was still shadows that I had to wrestle with. Once the shadows become visible, the work can begin.

I believe that there are many ways that we can come to terms with our shadow. I also believe men, more so than women, are more in need to learn who their true self really is. Broken men focus on status, money, sex, cars, and power. Many men, I included, spent the first 30 years of my life thinking that these artificial motives meant that I was successful.

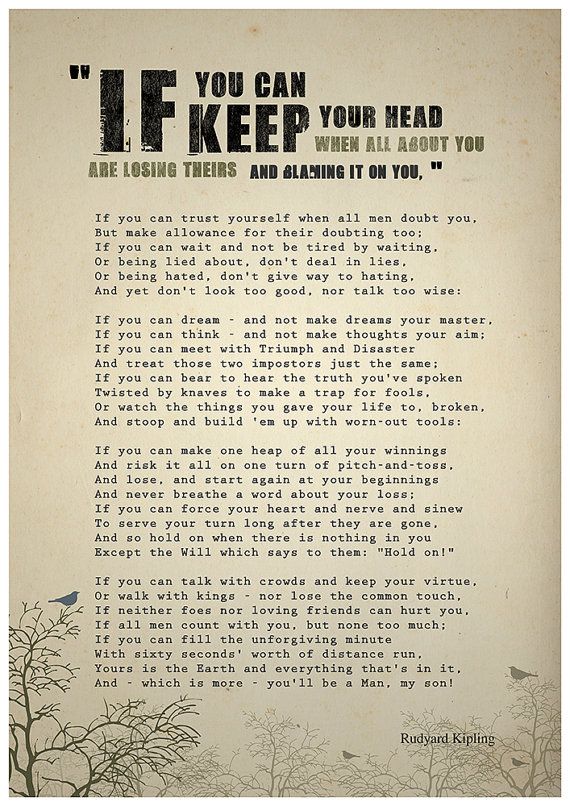

Throughout ancient times there are numerous rights of passage from childhood to manhood. These journeys are ceremonial and a part of society evolving leaders. In our day and age, I find broken men that have spent the energy to learn about their motivations fascinating. The men that I respect and am drawn to have gotten in touch with their shadows through, faith (typically born again more so than Catholic), addiction recovery, career military and in particular Marines, divorces where a man loses everything, business loss or any other event that forced the man to shake their beliefs to their very core. Through my work in Mankind Project I did the hard work, continue to dig into who I am and I’ve learned that many men are struggling to know who they are. Becoming aware of your ‘shadow’ or that part of you that is deeply buried and shows up to sabotage what is good, true and beautiful is the first step, understanding how the shadow part of our nature shows up in our lives is an ever happening journey. I’ve invited 8 men to the MKP weekend. All experienced profound awareness. Here’s what I learned from my journey (thanks to Nigel Stapelton for summarizing it so well). I am never done learning these lessons.

Throughout ancient times there are numerous rights of passage from childhood to manhood. These journeys are ceremonial and a part of society evolving leaders. In our day and age, I find broken men that have spent the energy to learn about their motivations fascinating. The men that I respect and am drawn to have gotten in touch with their shadows through, faith (typically born again more so than Catholic), addiction recovery, career military and in particular Marines, divorces where a man loses everything, business loss or any other event that forced the man to shake their beliefs to their very core. Through my work in Mankind Project I did the hard work, continue to dig into who I am and I’ve learned that many men are struggling to know who they are. Becoming aware of your ‘shadow’ or that part of you that is deeply buried and shows up to sabotage what is good, true and beautiful is the first step, understanding how the shadow part of our nature shows up in our lives is an ever happening journey. I’ve invited 8 men to the MKP weekend. All experienced profound awareness. Here’s what I learned from my journey (thanks to Nigel Stapelton for summarizing it so well). I am never done learning these lessons.

- Emotional Authenticity – As a man I need to share how I feel, in a healthy and clean way. Not bottle things up and shove things down deeper.

- Leadership Mastery– I am a leader, a role model and I am enough. I just didn’t realize it, or could not access those parts of me due to the masks, shields, and barriers that I had put up.

- Personal Responsibility– I learned the real value of integrity and accountability and that I am 100% responsible for my feelings and I own the impacts – both positive and negative – of my choices and actions.

Quick Tips The Sum It All Up For Me:

1 Intelligence is more than a person’s IQ. Emotional Intelligence has gained momentum recently. I subscribe to the 8 Intelligence described by Harvard’s Howard Gardner. Working on all 8 is a life-long journey. Henry Rollins Letter to Youth.

2. Father Richard Rohr, interviewed by Krista Tippet talks about rowing to and from the shore. A friend of mine gave me a book that explains the concept very well. The Anatomy of Peace by The Arbinger Institute is worth a read.

3. Surviving the Holocaust and losing your fortune to a Ponzi scheme would be devastating to anyone. Listen to how the author of Night, Elie Wiesel responds to losing his life’s fortune to the Bernie Madoff Ponzi scheme. Now, this is a man that knows what is important.

Farming and a Simple Life;

Blessed is how I look back on my childhood. I was born in a small town in Wisconsin at a time when the center of America was the small town and the idyllic life depicted in Norman Rockwell’s portraits of America was my backyard. Our town had a couple stop lights and is made up of multi-generation German, Norwegian or Irish families. The wealthiest family owned the John Deere dealership and everyone knew each neighbor and their kids and their grandparents. One of the chapters in my book on the Decline of America relates to the ramifications surrounding the decline in farming and the rural community and the flight into the cities. The shift clearly had economic impacts but more importantly, the disruption of families and small-town communities left America worse off.

Blessed is how I look back on my childhood. I was born in a small town in Wisconsin at a time when the center of America was the small town and the idyllic life depicted in Norman Rockwell’s portraits of America was my backyard. Our town had a couple stop lights and is made up of multi-generation German, Norwegian or Irish families. The wealthiest family owned the John Deere dealership and everyone knew each neighbor and their kids and their grandparents. One of the chapters in my book on the Decline of America relates to the ramifications surrounding the decline in farming and the rural community and the flight into the cities. The shift clearly had economic impacts but more importantly, the disruption of families and small-town communities left America worse off.

Our family moved to Tucson when I was in second grade but I traveled back for summers on the farm. My grandparents started visiting and living with us for 3 then 4 then up to 5 months a year to escape the cold Wisconsin winters. The ability to spend that much time with Ed and Leonette Cody was a major impact on who I am today. The Cody’s had a beef farm and a butcher shop outside of town. Durin a time when grocery shopping meant a trip to the baker and then over to the butcher, a visit to Cody’s Meats was an adventure. Ed and Leonette had 8 kids who went on to have over 50 grandkids. Family events and gatherings were major productions. There was always laughter, tons of teasing and always someone to spend time with. We didn’t have organized sports but everyone was in 4H with a show steer. We worked sun up to sun down cutting, moving and putting hay up in the barn for winter feeding. We rode in the back of pick up trucks and I’ve got cousins with missing fingers because they were caught in farm implements. We watched and at times helped calves being born and prepared pigs for cookouts.

Whatever happened in that Cody clan, the number of entrepreneurs that were generated from the aunts and uncles and all the grandkids is astonishing. Some stayed in the cattle business, others like myself and continued to take the road less traveled. The confidence and role models and lessons that were taught on that small farm are will with me almost 50 years later.

The life was extremely simple yet amazingly hard. At the end of the day, we really felt like we had achieved something important. To get a sense of what life was like when the small family farm was the backbone of America, I can’t recommend enough watching Trouble Creek – A Midwestern.

One of the chapters in my book in process, Decline of America, I argue that a move from a rural and agrarian society into the cities is changing America, and not for the better. As the small farm declines so do the small towns surrounding the farmers. As the small towns decline the entire social fabric of many regions changes. The connection with nature, the stewardship of a farm that may have been passed down from generation to generation. The rugged independence of a farming society and the focus on values and virtues that needed to be successful are unique to what made America great. Neighbors helped each other, kids grew up in tight night families that didn’t have iPhones and All-Star Soccer leagues, but instead, kids grew up with chores and hours and hours of creative play. If you have an opportunity to hire a farm boy or girl jump at it, you won’t be sorry.

Health and Family

My Kids –

This is a great video made by my daughter that captures the essence of what great kids I have:

Business – Deep Thoughts on the ‘WHY?’ of the Human Condition

Business Principals

Every business I go into happens after hundreds of hours of research and on the ground discussions of people already in the business. What I do is the epitome of high risk. Business start-ups are the hardest of the hard. Many people may have a good idea but I’ve been able to build a business from an idea, over and over again. To then scale up an idea is even harder. To be in business longer than 5 years where 90% fail is even harder. I’ve hit the 5-year mark six times. God has been blessing me for a long time. He has opened and closed doors to me all with the goal of making me stronger and making my impact on society through my skill set ever bigger.

Bet The Jockey

I’ve been an entrepreneur for over 30 years. There a number of analogies I use to explain what it’s like to do what I do. Skydiving without a parachute is sometimes what it feels like or Cortes in 1519 that landed in Veracruz and burned the ships to ensure total commitment to his adventure.

I’ve been an entrepreneur for over 30 years. There a number of analogies I use to explain what it’s like to do what I do. Skydiving without a parachute is sometimes what it feels like or Cortes in 1519 that landed in Veracruz and burned the ships to ensure total commitment to his adventure.

For me, the horse racing industry is an analogy that I particularly like. So here are the top 10 lessons I’ve learned in entrepreneurship, told through the lens of horse racing;

- You have to understand the horse you picked. To be a good horse racer, you have to know your horse’s lineage, breeding stock, strengths and weaknesses and positive and negative attributes. You have to do your homework. Just because a newborn quarter horse looks like the next Seabiscuit the day it’s born doesn’t mean he’s going to be Seabiscuit. Do your homework, research, study and chart a course towards the Triple Crown.

- In the beginning, get ready to make that horse your life! Your job as the owner/jockey of this potential winning thoroughbred, is to live, breath and embed yourself with this growing steed. Once you’ve picked your horse, your next 4 years is all about that horse.

- You have to anticipate what your horse will need. There are thousands of tactics that are mainstream and at times way out there, all techniques to build a great racehorse. Having a talented horse is one thing, knowing how to prepare him to be a winner is your job. Make sure you are ahead of the curve.

- You better understand your ownership team. People buy horses for a lot of reasons. If you have partners you better understand why they are in the racehorse business. If the ownership has ego driven, rich owners, that want to be in winner circle for the glory be careful. Some owners may be looking for your horse as winning the lottery…..one big score… to set them up in life (perhaps after years of picking the wrong horses). Is your ownership team going to second guess your every move? Does one of the owners, maybe the guy that’s been a car dealer all his life, now fancy himself as the worlds greatest trainer? Pick your owners (partners carefully). Know your ins and outs of the partnership. No matter how great the racehorse, if the owners aren’t aligned you are wasting your time. Time to find a new horse to run. A greedy owner will want to chase the big purses, even if your horse won’t be ready. An owner that is in the business for ego purposes will get bored with his investment if the wins stop coming.

- Carefully pick your races. There will always be pressure to enter new races (markets). Be patient, know your horse, know your end goals and don’t peak too early. Watch carefully number 4 …(ownership)…if your owners want to move to quick because of greed or pride, you could blow your one shot at glory.

- A great horse won’t win, without a great team. You may have a triple crown winner on your hands but without properly trainers, veterinarians, back office business staff, transportation companies and jockey’s your never going to perform at his peak potential. If you look at the top 10 jockey’s of all time you can see that they get really good at picking the right horse….and the right team. From the stable hand that may water your horse too much before a big race to the hotshot jockey that ensures a win, every detail is critical. You may have heard of legendary jockey Billy Shoemaker with $123m in lifetime purses. Pat Day and Jerry Bailey have lifetime wins just shy of $300m. What separates these jockeys form the heard? They know their horses and ownership teams pick them because they know how to win.

- Learn Your Horse and Learn HIS Strategy. Every horse has a personality and strengths and weaknesses. If you’ve raised your horse, you know where he performs the best. Don’t be afraid to pass on a ‘sure thing’ or stretch into a ‘long shot’ if you know your horse. Naysayers will constantly cherp in your ear what they think best. You know your horse and you need to have the inner fortitude to make the hard calls.

- Keep entering the races as long you’re having fun and finishing respectfully. There comes a point where every good horse has run their last race. Know when to give up and go out to pasture. In my business world, I’ve had over a dozen different startups and turnarounds. Each one had a moment where I knew it was time. Early in my career, I waited too long. Emotions and ego got in the way and it cost me money and embarrassed my ‘horse’ because it couldn’t compete anymore. Here are a few of my businesses and the moment that I knew it was time to give it up;

- Tiburon Diagnostic Lab – when insurance companies excluded us on key account – Result; laid off 34 staff members. This one was my hardest to work out by far.

- Talking Trash Waste Removal – when the ability to buy new trucks and fuel peaked at $4 per gallon – I sold the company to a competitor

- QMed Weight Loss Clinic – Cash Medical Care – the passage of Obamacare locked down entrepreneurial opportunities in the healthcare market.

- Gotta Go Wireless – as cell phones became commodities, I sold the stores to my managers and kept the top end revenue.

- Sports Buzz Haircuts – I realized that scaling from 9 to my goal of 50 would be difficult given the top line revenue and the caliber of the staff

- Big Time Balloon Advertising – when I watched a balloon turn off power on a Black Friday shopping day for an entire block of retail stores, I knew the liability was too great to continue.

- Silverbell Pavilion – an investment that looked great in 2007 turned into an albatross that could have taken me down during the recession of 2008. The options were limited and I did my best to do the right thing for the bank and my partners.

- Winning is as much luck and timing as it is skill and talent. No doubt it takes practice and talent to win the big races. But luck and timing are just as important. How many triple crown opportunities were dashed because of the rainy conditions at the Belmont that didn’t match the talents of the horse that already won the Preakness and Kentucky Derby? Making the rounds is a study by Cornell Economists that argue that you have to have luck to really hit it big. Of course, you can argue that the harder you work the luckier you are. People like Bill Gates and Mark Zuckerberg were of course at the right place at the right time. Contrast them with a Jeff Bezos or a Warren Buffet who made their fortunes over decades and you can see the debate that could be had over luck/talent.

As the essayist E.B. White once wrote, “Luck is not something you can mention in the presence of self-made men.” Some people are of course quick to acknowledge the good fortune they’ve enjoyed along their paths to the top. But White was surely correct that such people are in the minority. More commonly, successful people overestimate their responsibility for whatever successes they achieve.

- No matter how amazing your racehorse is, know when to find another. In the end, after you’ve done your best, sometimes you have to realize that it’s time to find a new horse. Remember, you’re a great jockey. Jockey will have a

- 30-year career and horses start at 2 years of age, peak at 4.5 years and decline for the next 3 to five years after that. Based on all I’ve detailed above, it’s hard not get emotionally involved in your racehorse. You’ve raised each other, you’ve learned from each other. you invested your time and energy into creating the perfect thoroughbred. You’ve had ups and downs and lived to race another day. It’s not easy to give it up and find another. But that’s exactly what has to be done when things are no longer working. If you’re lucky and smart about it, that horse can go out to pasture and have a long life. Who knows, you could develop another Tapit and pull in $35m a year without setting foot on another track. In the business world, what this looks like is realizing that you have an entity that no longer can compete and grow but still can provide ample revenue as it declines. I’ve had those type of entities and watched them slowly die out over time. I’ve also been in business that have their core revenue stream interrupted but because of what I’ve learned, I see new opportunities that I can branch into. I’ve been able to take what I’ve learned and reconstitute the team and start training a new horse. In the end always BET THE JOCKEY!

God And Economists Agree On One Thing (A Guide To Betting The Jockey)

(This article refers to investing in gold mining but the ideas apply on …Bet The Jockey). Here is what you should look for:

1. Have they done it before?

In his book “Principles” Bridgewater founder Ray Dalio writes that when hiring someone he checks to see if they’ve done the job at least 3 times before.

This controls for luck. Anyone can get lucky once, the blessed twice… but it’s hard to do so a third time. Anyone who has pulled off three wins is more likely to be competent.

2. Do they know how to fail?

One of the reason that David Lowell has made more discoveries than anyone else is that he knows when to kill a project. If a target isn’t shaping up the way he expects, he kills it quickly and moves on to the next. He doesn’t spend 5 years (and millions of dollars) praying the nex

t drill hole is the one that proves the theory – he moves on to something better.

Does management waste time on projects with no future? Have they killed projects in the past instead of wasting investors’ money? Did their first project just happen to be a big win?

These are things to look out for.

3. Do they only have one shot?

Things will go wrong. Definitely.

There will be delays. There will be cost overruns. There will be social issues. I’ve never heard of a project coming together without a complication. There are simply too many unknown unknowns in a mining project. Will the team be able to manage problems when they occur?

Do they have the budget to weather delays and setbacks? Do they have the faith of their backers and ability to raise more money when they need it? Or are they banking on everything going according to plan.

Because it won’t.

4. Do their incentives align with yours?

People do what they’re incentivized to do. Period.

This means that a management teams’ incentives need to match yours. They must be meaningful shareholders, and their salaries should be good but not cushy. They need to win if, and only if, shareholders win.

If they have the opportunity to slowly dwindle away the cash in a plush office on $300k a year regardless of what happens to the project… you’re screwed.

5. Give credit where credit is due

For every successful project there are a dozen people who claim responsibility and leverage it for the remainder of their career; or in the words of JFK “Success has many fathers, but failure is an orphan”.

Don’t be fooled. Most big wins come down to the ability or the effort of one or two key people who get it over the line; everyone else is just helping. Just because someone is a good addition to a winning team does not mean that they can repeat the process on their own. From every successful team you’ll get half a dozen spin outs who try and do it themselves. Do your homework and be sure to give credit where credit is due.

The Best of The Best Business Interviews

I’ve been drawn to Seth Godin and his philosophy around education, the future and what society needs in the future. Are you an artist? Give this a listen and start growing your inner artist!

https://youtu.be/k_FqC61S0oc

One of my favorite podcast is Entreleadership. It’s part of the Dave Ramsay network. This interview with the CEO of Ace Hardware nails what it means to run a successful business. Listen closely, this interview:

As a CEO and having done turnarounds, the key to fixing and growing a company is building out a great team and focusing on building a great culture. I stumbled upon 5 Dysfunctions of a Team by Patrick Lencioni and loved the way he uses the story to teach a lesson. His new book points out how to be humble and hungry.

I’m not a real sports fan. The only sport I’ve really ever gotten into is college football. I’m a big Notre Dame fan and have been to South Bend on a number of occasions and actually stayed in one of Knute Rockne’s homes. Notre Dame football is something special I share with my Dad and brother in law. I enjoy college football because it is fraught with errors and mistakes. I enjoy the drama built around recovering from those mistakes. I find the NFL too produced and frankly too perfect. Sports, in general, is the one place in society that where you get ahead on pure talent. Your education, your family upbringing or what neighborhood you grew up in means nothing. Talent is everything. That’s why I like it.

I enjoy and understand the ranking system found in College football. The ranking allows a novice to pick up a game and immediately understand the drama between the teams. I love the age long rivalries and in state matches. Michigan, Ohio State, Alabama, USC all have dominant systems but each has stumbled and had to rebuild. Those long dynastic dramas playing out are amazing to watch.

So with all of the above explanations, there is no one bigger to me in football than Lou Holtz. Here’s one his better interviews:

Want to know what the future of the world is going to look like? Check out the analysis by Elmor of Generation Z. They are still in elementary school but they will eventually rule the world.

I grew up in the 1980’s. Grandson of a Butcher, the son of a Butcher, a transplant to Arizona via Wisconsin. Our entire family and community where JFK Democrats. From an early age, I identified with the Republican philosophies and with a huge streak to chart my own course as an entrepreneur. I grew up on Reagan and American exceptionalism. Check out the CNN 80’s series to get a sense of the time that formed who I am.

I grew up in the 1980’s. Grandson of a Butcher, the son of a Butcher, a transplant to Arizona via Wisconsin. Our entire family and community where JFK Democrats. From an early age, I identified with the Republican philosophies and with a huge streak to chart my own course as an entrepreneur. I grew up on Reagan and American exceptionalism. Check out the CNN 80’s series to get a sense of the time that formed who I am.

Watch it HERE

I listen to and learn a lot from Entreleadership podcast. I have researched a number of personality assessment systems and have implemented 16 Personalities . This is a powerful tool for any family or business. Ian Morgan Cron did a large study of CEO’s and found that the highest predictor success is knowing your own strengths and weaknesses. Give a listen HERE.

Goals, Persistence, Business

The story of the Wright Brothers as told by David McCullough ties in classical education, work ethic, midwestern values, and tenacity. For a great lecture on what is possible spend an hour HERE.

Power, Who Has It, How Do You Use It and What It Looks Like

I read Robert Greene’s book, 48 Laws of Power and got a lot out of it. After listening to his life story, I want to dig into his new Mastery. I’ve referenced Malcolm Gladwell and his books about what separates common from great, it sounds like Mastery will be right up my. ally! This is a great interview that explains, once again, my theory that without understanding your own emotional motivations you will be short lived as a leader. Give it a listen.

I read Robert Greene’s book, 48 Laws of Power and got a lot out of it. After listening to his life story, I want to dig into his new Mastery. I’ve referenced Malcolm Gladwell and his books about what separates common from great, it sounds like Mastery will be right up my. ally! This is a great interview that explains, once again, my theory that without understanding your own emotional motivations you will be short lived as a leader. Give it a listen.

Robert Greene is the author of the New York Times bestsellers The 48 Laws of Power, The Art of Seduction, The 33 Strategies of War, and The 50th Law. His highly anticipated fifth book, Mastery, examines the lives of great historical figures such as Charles Darwin, Mozart, Paul Graham and Henry Ford and distills the traits and universal ingredients that made them masters. In addition to having a strong following within the business world and a deep following in Washington, DC, Greene’s books are hailed by everyone from war historians to the biggest musicians in the industry (including Jay-Z and 50 Cent). Greene attended U.C. Berkeley and the University of Wisconsin at Madison, where he received a degree in classical studies. He currently lives in Los Angeles.

Here’s The Learning Leader page. And from the show notes, below is the takeaways for me:

- Sustained Excellence:

- Self Mastery

- Self Control — “We are emotional animals, governed by emotions. It can get you in trouble.”

- Self Discipline

- Flexibility — Ability to adapt

- Why was Napoleon successful? He had a front line obsession

- Law 4 – Always say less than necessary. “Do not speak unless you can improve upon the silence.”

- Learn the power of being quiet

- If you’re upset about an email, do not respond emotionally. Wait 24 hours and then respond with a level head

- Law 9 – Win Through Your Actions, Never Through Argument. “Demonstrate, do not explicate.”

- “Show them. Don’t talk.”

- Law 10 – Infection: Avoid The Unhappy and Unlucky

- You are the average of the 5 people you spend the most time with

- “We absorb the energy of other people.”

- Look to “level up” your peer group at all time”

- How to deal with a person in a power position who you do not like or respect?

- Do not let them see you upset. Do not show them emotion (when they try to rile you up)

- “The human brain does not learn unless it is excited”

- Cesar Rodriguez — “Trust The Process” — You must get reps, reps, reps in order to achieve any level of excellence

- Think long term and put in the necessary work to be great

- Advice: “You were born with a purpose. Tap into what makes you different and unique. There is tremendous pressure to fit in. You will have success if you dig deep, be adventurous, try things out. Respect your unique-ness, something great will happen.”

Former Fed Chairman – Richard C. Koo

I stumbled upon this interview with former Fed Chairman Richard C. Koo, Chief Economist, Nomura Research Institute. The title of the talk is Surviving in the Intellectually Bankrupt Monetary Policy Environment. It’s long and sort of wonky but very enlightening. Koo ties in what Japan tried to do following their massive debt bubble that exploded in the late 1980’s. After our 2008 bubble, the US Fed is following the same footprint that ballooned Japan’s debt to GDP to more than 200%. Our economics is based on the assumption of profit maximization. However, what happens, when this assumption is no longer

Our economics is based on the assumption of profit maximization. However, what happens, when this assumption is no longer valid when companies pay down debt at zero interest rates? This is when the economy has entered a balance sheet recession. In such a situation, monetary policy becomes a largely useless weapon. After years of monetary policy with limited effectiveness, Richard C. Koo is asking: How can we escape from the QE-Trap? I can’t speak for anyone else but after the pain of the 2008 recession, even after 10 years, I’m much more cautious and careful in how I manage my businesses. As an entrepreneur, we are out flying without a net. A mistake can mean total loss of everything I’ve built up. I’ve been there and certainly don’t want to do that again. Multiply my experiences times all the enterprises in American and you get the gist of Koo’s hypothesis. I’m SLOWLY writing a 12 chapter book called The Decline of America. Each chapter argues another point that focuses on major fundamental flaws in the American society that, when taken all together, paint a pretty bleak picture. My chapter on DEMOGRAPHICS is DESTINY helps explain Japan’s problem. All in all, you’re up to Tr$30. The low birth rate issue is plaguing most Western societies. If you ain’t growing, you’re dying.

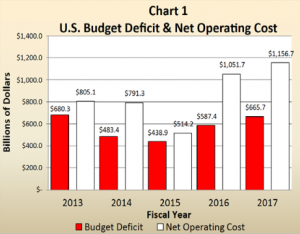

The official US debt is listed at $20 trillion. By adding the Tr$3.2 state/local debt to the total, as well as contingent liabilities such as Fannie, Freddie, and Ginnie: All in all you’re up to Tr$30. This number doesn’t include promises made by the US Government to its citizens (Medicaid, Medicare and Social Security are the biggest at an estimated $200T) It all works fine until it doesn’t. We are witnessing the biggest confidence game ever played in history.

It all works fine until it doesn’t. We are witnessing the biggest confidence game ever played in history. These numbers are so large, we are uncharted territory. When the world loses confidence in Japan, or Spain or Portugal or the US, the sucking sound of capital will be very loud. If history is a guide, expect a war of distraction, an exertion of States rights that could mean a civil war or long period of deflationary events.

What Makes A Good CEO?

A new book I’m reading and recommend on the role of understanding yourself as a leader. Check out The Accidental CEO

on February 25, 2008 (Review from Amazon)Format: Paperback

Nick Giambruno: How does an investor deal with being accurate but early?

Jim Rogers: Oh, that’s the story of my life. I’ve always been accurate but early.

If I’m convinced something is going to happen or if I should make an investment, I have learned that I should wait for awhile, because maybe it is too early. And it usually is too early.

I try to discipline myself to wait longer or to put in orders below the market and let the market come to me. But even then, sometimes I’m still too early.

Nick Giambruno: How did studying history help you in investing?

Jim Rogers: Well, the main thing it taught me was that everything is always changing.

If you go back and look at before the First World War, nobody could ever have conceived in 1910 that Germany and Britain would be slaughtering millions of people four years later. Yet it happened.

No matter what we think today, no matter what it is, it is not going to be true in 15 years. I assure you. You pick any year in history, and look at what everybody was convinced was correct and then look 15 years later, and you’d be shocked and astonished. Look at 1920, 15 years later. Look at 1930, 15 years later. Any year you want to pick – 1900, 1990, 2000. Pick any year and I assure you, 15 years later everything is going to be different. I guess that’s the first thing I learned from the study of history.

Nick Giambruno: What mistakes do empires always make?

Jim Rogers: They get overextended. They think they’re smarter than everybody else. They think they cannot make mistakes, and even if they are making mistakes they are so powerful they think that they can correct the mistakes. And then they become overextended. Usually they become overextended financially, militarily, geopolitically, in every way.

Nick Giambruno: Is the US repeating those same mistakes?

Jim Rogers: Well, the US is the largest debtor nation in the history of the world now, and the debts are going higher and higher. The people in the US think it doesn’t matter that we’ve got all these debts and there’s no problem. People in the US don’t think that it’s a problem that we’ve got troops in over 100 countries around the world. I mean, when Rome got overextended militarily, it paid the price. Spain and many other countries have had this problem. Maybe it’s not a problem. Maybe America can have troops in 200 countries around the world and it won’t matter, but America has certainly gotten itself overextended in many ways.

Nick Giambruno: Do you think wealth and power will continue to move East?

Jim Rogers: Wealth and power are moving East now, and that is going to continue. That’s because of historic reasons. There’s little doubt in my mind that China is going to be the next great country in the world. Most people are still skeptical of that. Most people know something is happening in China. They don’t really quite understand the full historic significance of what is happening in China including many Chinese.

If you made it this far into my business post here’s an interesting prediction done in October of 2017 on what the next financial downturn will look like. History is showing that it takes more and more fuel to the fire to turn around these recessions because of the massive amounts of leverage which is created after each downturn. The student loan debt, corporate leveraging, intervention by the Fed are going to be the housing bubble of 2008. Trump’s tax plan will boost some adrenaline into the economy but normal business cycles of highs and lows occur, on average every 7 years. We are on year 9 since the 2008 downturn. This is a bit wonky but check out the bullet points;

What Will the Next Crisis Look Like?

By Marko Kolanovic, PhD, and Bram Kaplan

October 3, 2017Next year marks the 10th anniversary of the Great Financial Crisis (GFC) of 2008 and also the 50thanniversary of the 1968 global protests against political elites. Currently, there are financial and social parallels to both of these events. Leading into the 2008 GFC, some financial institutions underwrote products with excessive leverage in real estate investments. The collapse of liquidity in these products impaired balance sheets, and governments backstopped the crisis. Soon enough governments themselves were propped by extraordinary monetary stimulus from central banks. Central banks purchased ~$15T of financial assets, mostly government obligations. This accommodation is now expected to reverse, starting meaningfully in 2018. Such outflows (or lack of new inflows) could lead to asset declines and liquidity disruptions, and potentially cause a financial crisis. We will call this hypothetical crisis the “Great Liquidity Crisis” (GLC). The timing will largely be determined by the pace of central bank normalization, business cycle dynamics and various idiosyncratic events, and hence cannot be known accurately. This is similar to the 2008 GFC, when those that accurately predicted the nature of the GFC started doing so around 2006. We think the main attribute of the next crisis will be severe liquidity disruptions resulting from market developments since the last crisis:

- Decreased AUM of strategies that buy Value Assets: The shift from active to passive assets, and specifically the decline of active value investors, reduces the ability of the market to prevent and recover from large drawdowns. The ~$2T rotation from active and value to passive and momentum strategies since the last crisis eliminated a large pool of assets that would be standing ready to buy cheap public securities and backstop a market disruption.

- Tail Risk of Private Assets: Outflows from active value investors may be related to an increase in Private Assets (Private Equity, Real Estate and Illiquid Credit holdings). Over the past two decades, pension fund allocations to public equity decreased by ~10%, and holdings of Private Assets increased by ~20%. Similar to public value assets, private assets draw performance from valuation discounts and liquidity risk premia. Private assets reduce day-to-day volatility of a portfolio, but add liquidity-driven tail risk. Unlike the market for public value assets, liquidity in private assets may be disrupted for much longer during a crisis.

- Increased AUM of strategies that sell on ‘Autopilot’: Over the past decade there was strong growth in Passive and Systematic strategies that rely on momentum and asset volatility to determine the level of risk taking (e.g., volatility targeting, risk parity, trend following, option hedging, etc.). A market shock would prompt these strategies to programmatically sell into weakness. For example, we estimate that futures-based strategies grew by ~$1T over the past decade, and options-based hedging strategies increased their potential selling impact from ~3 days of average futures volume to ~7 days of average volume.

- Trends in liquidity provision: The model of liquidity provision changed in a close analogy to the shift from active/value to passive/momentum. In market making, this has been a shift from human market makers that are slower and often rely on valuations (reversion), to programmatic liquidity that is faster and relies on volatility-based VAR to quickly adjust the amount of risk taking (liquidity provision). This trend strengthens momentum and reduces day-to-day volatility, but increases the risk of disruptions such as the ones we saw on a smaller scale in May 2010, October 2014 and August 2015.

- Miscalculation of portfolio risk: Over the past 2 decades, most risk models were (correctly) counting on bonds to offset equity risk. At the turning point of monetary accommodation, this assumption will most likely fail. This increases tail risk for multi-asset portfolios. An analogy is with the 2008 failure of endowment models that assumed Emerging Markets, Commodities, Real Estate, and other asset classes are not highly correlated to DM Equities. In the next crisis, Bonds likely will not be able to offset equity losses (due to low rates and already large CB balance sheets). Another risk miscalculation is related to the use of volatility as the only measure of portfolio risk. Very expensive assets often have very low volatility, and despite downside risk are deemed perfectly safe by these models.

- Valuation Excesses: Given the extended period of monetary accommodation, most of assets are at their high end of historical valuations. This is particularly true in sectors most directly comparable to bonds (e.g., credit, low volatility stocks), as well as technology- and internet-related stocks. Sign of excesses include multi-billion dollar valuations for smartphone apps or for ‘initial crypto- coin offerings’ that in many cases have very questionable value.

We believe that the next financial crisis (GLC) will involve many of the features above, and addressing them on a portfolio level may mitigate the impact of next financial crises. What will governments and central banks do in the scenario of a great liquidity crisis? If the standard rate cutting and bond purchases don’t suffice, central banks may more explicitly target asset prices (e.g., equities). This may be controversial in light of the potential impact of central bank actions in driving inequality between asset owners and labor (e.g., see here). Other ‘out of the box’ solutions could include a negative income tax (one can call this ‘QE for labor’), progressive corporate tax, universal income and others. To address growing pressure on labor from AI, new taxes or settlements may be levied on Technology companies (for instance, they may be required to pick up the social tab for labor destruction brought by artificial intelligence, in an analogy to industrial companies addressing environmental impacts). While we think unlikely, a tail risk could be a backlash against central banks that prompts significant changes in the monetary system. In many possible outcomes, inflation is likely to pick up.

The next crisis is also likely to result in social tensions similar to those witnessed 50 years ago in 1968. In 1968, TV and investigative journalism provided a generation of baby boomers access to unfiltered information on social developments such as Vietnam and other proxy wars, Civil rights movements, income inequality, etc. Similar to 1968, the internet today (social media, leaked documents, etc.) provides millennials with unrestricted access to information on a surprisingly similar range of issues. In addition to information, the internet provides a platform for various social groups to become more self-aware, united and organized. Groups span various social dimensions based on differences in income/wealth, race, generation, political party affiliations, and independent stripes ranging from alt-left to alt-right movements. In fact, many recent developments such as the US presidential election, Brexit, independence movements in Europe, etc., already illustrate social tensions that are likely to be amplified in the next financial crisis. How did markets evolve in the aftermath of 1968? Monetary systems were completely revamped (Bretton Woods), inflation rapidly increased, and equities produced zero returns for a decade. The decade ended with a famously wrong Businessweek article ‘the death of equities’ in 1979.

Want A Great Culture? This Bundles It Up.

I’ve been a part of a number of great teams and lead a few. When the group comes together and the safety is there, amazing cultures can be built. I’m leading a group just like that right now.

Episode 242: Daniel Coyle – The Secret Of Highly Successful Groups (The Culture Code)

Show Notes:

- Sustained Excellence = “They’re over themselves” – They do not have an ego. They figure out the big truths, get over feelings, have clarity, vision. Great communicators – Like an athlete, they can be obsessed. Keenly aware, active listeners, intentional with actions.

- “As leaders, we need to create the conditions for excellence”

- The 3 Skills — 1) Build Safety 2) Share Vulnerability 3) Establish Purpose

- Build Safety – Why do a group of kindergartners do better than a group of CEOs? The kindergartners have now agenda or care about credit. They focus on doing the best work. CEOs (in the study) were worried about who got credit and tearing each other down.

- Safety is the single most important piece of foundation needed for great culture

- A painstaking hiring process – The single most important decision is “who’s in and who’s out.”

- You should script the entire first few days of a new employees time at a company — Pixar example (20 minute mark) — “At Pixar, we hired you because we need you to help us make our movies better.”

- John Wooden would routinely walk the locker room and pick up trash

- Share Vulnerability – Functional notion that’s so important

- “Sharing a weakness is the best way to be strong” — Navy SEALs example: The AAR (After Action Review)

- The most important 4 words a leader can say, “Anybody have any ideas?”

- Also, “I screwed up”

- How to be a great listener

- “Your goal as a listener should be to add energy.” Ask questions, don’t just sit there and nod. Listen and absorb. Help them leave higher than when you arrived. Follow up to go deeper. Being a great listener is a heroic skill.

- Have “empathy and energy” as a listener — dig in to assumptions (unearth)

- Great teams are made up of players who don’t want to let their teammates down.

- Build a wall between performance review and professional development — When you combine the two, you get neither. Toggle, create safety so you can be more open and honest.

- Establish Purpose

- Value statements aren’t super useful — “fill the windshield with a story.”

- Clear narratives guide attention

- Name and rank your priorities

Here’s Why I Don’t Play The Stock Market

This Conversations With Tyler interview of Cliff Asness is why I don’t invest in the stock market. People like Cliff are waiting for idiots like me to learn some fancy new trading scheme so they can clean my clock. This clip is wonkie and worth the watch. Here’s why I don’t invest in or believe in the Stock Market, guys like Cliff Asness are hyper-focused on taking rookies like me for a ride.. Guys like these are way-way better than I’ll ever pretend to be. I took a course in options trading of the SPX and learned a fun system. I played with fake money and did great. A bunch of friends played with REAL money and did absolutely amazing…for a while. That’s why my philosophy in business is to go slow in and get out quick if things aren’t working.

America is Synonymous With Business – Entrepreneurs Make America!

One of my favorite documentaries on a business visionary is Slingshot the story of Dean Kamen, the inventor of the Segway. The story chronicles his quest to cure the biggest problem facing the third world…clean water. Please watch this documentary and realize that it takes Dean Kamen’s to take the road less traveled. The entrepreneur, inventor and business pioneers from the past and from today will make society a better place to live.

Research on CEO Effectiveness

If you haven’t subscribed to Harvard Business Ideas podcast you are missing out. The interviews are short and always covering the cutting edge issues happening in American business.

HERE’s the Interview from Elena Botelho, partner at leadership advisory firm ghSmart, talks about the disconnect between the stereotype of the CEO and what research shows actually leads to high performance at that level. She says the image of the charismatic, tall male with a top university degree who’s a strategic visionary and makes great decisions under pressure is a pervasive one. However, research shows that four behaviors more consistently lead to high performance in the corner office: 1) deciding with speed and conviction 2) engaging for impact 3) adapting proactively 4) delivering reliably. Botelho is the co-author of the article “What Sets Successful CEOs Apart” in the May-June 2017 issue of Harvard Business Review.

Money – What’s Your Relationship with Money?

I’ve had my stage of more is better. The cars, the bling and all the hallow rewards that money parts of my past. I live a life of abundance, but that doesn’t happen to mean the size of my bank account. You’ve heard the stories about great grandparents that lived through the depression and have forever been changed. Since they’ve lived through the scarcity of a prolonged time of strife, Great Depression survivors carried that attitude for the rest of their life. Having lived through the 2008 to 2016, Great Recession, I learned some valuable lessons about the power of money as a scorecard for success. I believe I will forever be changed.

Lynne Twist: “What You Appreciate Appreciates” | SuperSoul Sunday | Oprah Winfrey Network

Questions to Bring More Gratitude into Your Life | SuperSoul Sunday | Oprah Winfrey Network

Lynne Twist: “What You Appreciate Appreciates” | SuperSoul Sunday | Oprah Winfrey Network

Freedom from the money culture | Lynne Twist | TEDxBerkeley

History – Deep Thoughts on the ‘WHY?’ of the Human Condition

History

Does history repeat itself? Kitty Werthmann has an amazing story about her early life in Nazi Germany.

I’ve been really keying in on the Revolutionary War in America. The characters, the stories and the events that lead up to the Declaration of Independence are fascinating to study. The balance of power, the upper and lower chambers, the role of States rights in a federalist system are all derived from the study of civilizations of the past. The Roman and Greek influences on the Founders of the USA are evident throughout the founding of America. Some of the books I’d recommend on the revolution and the founding of America include A Leap into the Dark by John Ferling, Founding Brothers by Joseph Ellis, and any number of the David McCullough stories. Here’s a great video that encapsulates how amazing the idea of America really is historical;

Speaking of Founding Fathers, one of my go to podcasts, Mises Weekend covered the genius of Thomas Jefferson with historian Kevin Gutzman:

To go way back, Victor Davis Hanson put events of today into perspective by understanding the events of the past. This Book TV is long but really important to watch and tie back to events of today.

https://youtu.be/kp06Cnwa-X4

and here:

And a lecture on the Greeks that lead to the American Founders and 3000 years of Western Thought:

https://youtu.be/r-pOwv6ZIbM

An amazing archive interview from Diane Rheem with Tim Russert. This book and Tim’s explanation of his Dad is powerful. Big Russ grew up in the Depression and is from the silent generation. Here’s Tim explaining his Dad, Big Russ. So for my Dad, my Granddads and to hopefully be the Dad in that models the Big Russ life.

An amazing archive interview from Diane Rheem with Tim Russert. This book and Tim’s explanation of his Dad is powerful. Big Russ grew up in the Depression and is from the silent generation. Here’s Tim explaining his Dad, Big Russ. So for my Dad, my Granddads and to hopefully be the Dad in that models the Big Russ life.

Victor Davis Hanson is a professor with a strong Classical Education background. His grasp of ancient history and how it relates to today is very enlightening. This lecture series was recorded back in 2008 so there is a lot of references to the Gulf Wars. The ideas and topics are timeless.

Part 2 – HERE

Part 3 – HERE

Part 4 – HERE

Guns, Germs and Steel by Jerrod Diamond – HERE

Diamond’s deep dive into why one society rises and another doesn’t during the same time period is well thought out and argued. The book won a Pulitzer for a reason.

The Greatest Generation and the Great War – A History Lesson

Again with the Victor David Hanson! His new book on WW2 sounds like a great read. Here is he speaking from the Hoover Insitute on the nuances of the Axis vs the Allied strategies that lead to World War 2.

and Part 2 of this interview – HERE

Economics – Deep Thoughts on the ‘WHY?’ of the Human Condition

Economics

I love economics and how economic theories have advanced and declined over the generations. Perhaps one of my favorite communicators on an economic theory I subscribe to is Milton Friedman. Friedman’s 10 part series that that played a few decades ago. In the series, he weaves stories and is faced by a panel of peers that agree and disagree with his beliefs. He’s famous for many analogies but the pencil manufacturer is probably one of his most famous.

Friedman’s appearances on Phil Donahue, the Oprah of his time brought economics to the masses. His debates with Phil are very telling in Donahue’s leanings and how amazing Milton was as the art of debate:

Friedman’s 10 part series on PBS featured great stories, Milton’s philosophy and a debate panel of economic experts that are for and against his theories.

Friedman on the Road To Serfdom – HERE and Friedman vs Bernie – HERE

Where Friedman was at his best was during a college campus Q&A session. Here’s one of my favorites:

And Milton on what is America:

The debate of the last 100 years has been John Maynard Keynes and F.A. Hyack regarding their boom and bust cycles and the roll of government intervention in markets through interest rate manipulations. These two economic rap videos make it fun to learn the philosophies. Sadly, Keynes has dominated and $20 trillion later what do we have to show for it?

and part 2

Here’s a deeper dive into Keynes and Hayek.

I’m pretty contrarian on where we are as a county. The role of central banking in the last 45 years will be looked on as having major manipulations of markets. Between debt loads, crony capitalism, and easy money policies, we are so far removed from reality it scares me. This will not end well, the markets always correct itself.

Want to know how bad the problem really is? You can point to Detroit (probably one of my top 5 interviews), or Illinois, or New Jersey but nothing compares to what’s going on in Puerto Rico. This AEI panel discussion is long, about 2 hours, but the math surrounding the obligations of the tiny island will shock you. Whomever green light lending these kinds of dollars to this Country should get the haircut they deserve. Sadly, over promised public pensions and crippling debt may leave Puerto Rico with the only option of going hat and hand to Congress.

Want to know how bad the problem really is? You can point to Detroit (probably one of my top 5 interviews), or Illinois, or New Jersey but nothing compares to what’s going on in Puerto Rico. This AEI panel discussion is long, about 2 hours, but the math surrounding the obligations of the tiny island will shock you. Whomever green light lending these kinds of dollars to this Country should get the haircut they deserve. Sadly, over promised public pensions and crippling debt may leave Puerto Rico with the only option of going hat and hand to Congress.

Government Helping

Speaking of government warping markets. I’m not talking about health care or affordable housing, let’s take a look at higher education:

Spent the weekend up in Phoenix and all over the radio, on billboards and in print magazines I saw ads for the UofA MBA program……why? Hint, it’s where people can afford and can benefit from a Masters in Business.

In the past few years, tuition has increased, we’ve built a new stadium, a student gym/pool, hired two deans for diversity and inclusion, a social justice advocate (story picked up nationally as a snitch position).

Then from today’s Tucson paper:

The UA also opened a site in Cambodia last year and plans to launch 11 more as follows:

UA Amman at Princess Sumaya University of Technology, Jordan

UA Bandung at Telkom University, Indonesia

UA Beirut at Lebanese International University, Lebanon

UA Hanoi at Vietnam National University

UA Hualien City at Tzu Chi University of Science and Technology, Taiwan

UA Manila at De La Salle University, Philippines

UA Puebla at Universidad Popular Autónoma del Estado de Puebla, Mexico

UA Shanghai at Shanghai University of Politics and Law, China

UA Sharjah at the University of Sharjah, United Arab Emirates

UA Shenzhen at the Harbin Institute of Technology, China

UA Taipei at Soochow University, Taiwan

Tucson students with the means to travel would be able to take UA classes at any of the international sites.It is the 150th anniversary of the Morrill Land-Grant Act of 1862, which led to the establishment of public land-grant institutions including the UA.

I wonder if the UofA is sort of losing their mission to the scholars of Arizona. It’s an interesting debate but as ITT Tech and Univ of Phoenix get their hands slapped for being for profit, how is the UofA’s use of public/private funds to do all of the above a good thing?

Cant Escape The Market Forces

Some of the thought leaders that I seem to be agreeing with more and more include Richard Duncan. Here’s an interview he did with Gordon T Long:

Another contrarian that has actually been a major player in the Reagan administration that I follow is David Stockman.

Jeromy Grantham is the co-founder of GMO capital. His quarterly newsletter is a must read. Here he is with Charlie Rose:

Speaking of Contrarian –

Give a listen to Econo Talk’s interview with CATO’s David Boaz, and columnist/authors P.J. O’Rourke and George Will. Will make an interesting point about since the Great Depression there have been very small moments in time where liberals actually had control and a ‘mandate’ to govern. Those times started with FDR and a two year period where he attempted to pack the Supreme Court. LBJ and a two year period where the War on Poverty, Social Security, and Medicare came into existence and the 2008-2010 period under Barack Obama. During these brief two-year periods, major shifts to the left occur, the voters shift back to a center-right government and the laws enacted during those periods are extremely difficult to undo. Think Obamacare. Jump to 46:00 where Will takes down Academia. The panel talks about ‘Dictator for the Day Legislation’ and they weigh in on how to fix America. The ideas and suggestions include;

1. Get government totally out of K12.

2. End tax withholding. Make people write out their payroll withholding payment. By the way who is FICA?

3. Term limits or incumbents can’t stand for re-election if the government is in a deficit of more than 1% of GDP.

4. On all government deficits – all the taxpayers would be assessed on their tax form.

5. End of 1040 has tax payers fill in where they want their money to go…and have a line for ‘send my money back to me’.

6. I particularly like the idea of a balanced budget amendment passed by the States. I also like electing Senators from State Legislatures instead of by popular vote. Both of these ideas bring power back to the States.

Why are Libertarian ideas not taking root in the world? The answer is at the end of the podcast. Basically, it’s hard for people to accept that work, thrift and delayed gratification is good for you. That’s a tough political platform in this day of instant gratification.

This episode of EconTalk is being recorded in front of a live audience in Washington, D.C. in honor of the 40th Anniversary of the Cato Institute. Our topic is the past, present, and future of liberty. And to talk about it we have three special guests, David Boaz…, P. J. O’Rourke…, and George Will…. So, I want to start with the state of liberty in America. Is the glass half full or half empty? David, why don’t you lead us off?

Russ Roberts: I’m going to pile on. And I’ll let David and P.J. react accordingly if they wish. So, David, you pointed out marginal tax rates have come down, but government hasn’t gotten any smaller. Government continues to get larger. The nanny state continues to be more intrusive. Economics gets, as you say, the welfare state and various regulations–some have gone away. The cost of this is that everything that is bad about the current system is blamed on markets, even though it’s not a market process. So, the fact that United once dragged a passenger off a plane with Federal agents is an indictment of deregulation now. I’ve actually read things like that. Or that airline travel is so horrible because it’s just cheap. Or, the health care system proves that markets don’t work–when of course we’ve managed to remove almost every bit of market process that could be there to start with. So, on the facts I think it’s a tough argument that the glass is half full. Do you want to push back against that?

The Wealth of Nations – Adam Smith

I’m going to reference economic theories that I subscribe to, I would be remiss if I didn’t dig into the ideas of Adam Smith.

Economic Documentaries Worth A Watch

Here are some thought-provoking documentaries that line up on both sides of the political aisle. The common theme is the intersection of government, banking, and business

The common theme is the intersection of government, banking and business isn’t good for the economy and our future. I can take issue with individual arguments but the overarching themes are important to digest.

Overdose: The Next Financial Crisis

Requiem for the American Dream

EconoTalk with Russ Roberts

Another podcast I enjoy is EconoTalk with Russ Roberts. He and Tyler Cowen (to some degree Malcolm Gladwell and the team at Freakonomics) help take complex subjects, package them in palatable terms and deliver them to us listeners. This week, Russ interviewed Phillip Auerswald

Another podcast I enjoy is EconoTalk with Russ Roberts. He and Tyler Cowen (to some degree Malcolm Gladwell and the team at Freakonomics) help take complex subjects, package them in palatable terms and deliver them to us listeners. This week, Russ interviewed Phillip Auerswald

Give it a listen HERE

About 5 years into my 7-year radio career, after the 2012 election, I started noticing patterns that didn’t point in a positive direction with respect to the future of our Country.From 25 topics I’ve winnowed the list down to 12. I’m working on the outline of a book with a working title of the Dozen Trends that Spell the End of a Great Civilization. Philip Auerswald, hit chapters 3 (flight to the cities), 9 (demographics is destiny) and 11 (polarized political parties).

There is a lot of trade-offs with the 50-year migration from an agrarian and rural economy into the city, but there are also social ramifications that are right now being played out.

(Exert from my book) -The Decline of Rural America and Rise of The Blue Wave

As America moved from a rural, agricultural population and economy to what’s now densely populated urban megalopolises the entire fabric of America has changed. The small town I grew up in 40 miles east of Minneapolis is a perfect example of what’s happening all across America. New Richmond Wisconsin was once dominated by small dairy and beef farms. With a population of under 5,000, the area was settled by Irish and Norwegian immigrants. Large families, one stop light towns, a strong faith-centered community was the way I remembered my upbringing. My grandparents had a small farm with a butcher shop just outside of town. People would make the rounds to the baker, the butcher and spend an hour talking about the happenings of their families and their community. Our small town is now a bedroom community to the Twin Cities. The farmland has given way to housing tracts. In search of cheap housing and fueled by expanded interstates, the 40-minute drive to the jobs of Minneapolis is now a daily occurrence for thousands of workers. With the conversion of small family farms to master-planned neighborhoods, something is lost. The intimate understanding of your community and the ‘we are all in this together’ attitude that built America has given way to gated neighborhoods and walled off subdivisions.

Through the 1800’s cities like New York and Chicago were exemplified by immigrant neighborhoods, political machine politics, corruption, and exploitation. With the growth of megalopolis cities now almost in every state the same political machines have become much more sophisticated. The community I live in, Tucson Arizona and Pima County has been dominated by democratic machine politics for over 25 years. Once the machine is in place, they draw favorable electoral maps, they count and understand who votes and where. Patronage to favored developers, road contractors who in turn fund and underwrite political campaigns is the norm. The public sector unions understand that electing the right council or board of supervisors is good in the short run towards pay incentives and pension payouts. While property taxes, sales taxes, impact fees and regulations increase to pay for the bloated promises, the business class, job creators find the community unfriendly and difficult to do business in. Tucson has been compared to the Detroit of the Desert with flourishing suburbs and a decaying city core. There is always a push for revitalization or tax credits for favored industries in the name of spurring a resurgence to the inner city but these giveaways never see to last. Without a true level playing field with predictable rules and regulations my city, like hundreds around America have seen their tax base dwindle and their opportunities dissipate.

Political Machines

Political machines create an army of loyal professional bureaucrats. The bureaucracy knows to toe the party line. The politics of ‘no growth’ or ‘environmental activism’ or just plain old patronage takes root and it’s even harder to dislodge the culture of patronage once it’s established. At their worst, they just become a kleptocracy, too entrenched and handing out too many benefits to be uprooted. And the cost of maintaining the patronage system does real harm to the services the government should be providing.

This is not a victimless crime. Look at New York, where public unionized employees can make close to $100K a year + generous pension for jobs that would pay half that in the private sector. Great for those who have the jobs, but it means the city can’t fill the potholes or paint the subway stations. It’s not a handshake with a wad of cash, its unions getting cush contracts in return for mobilizing their workers at the ballot box. People should be paid fairly, with benefits, for work done, not given free money just for being part of a system.

Hanomy

I stumbled upon the ideas of (Han) Wisate based on a comment on an article. The comment leads to his web page Hanomy. Wisate’s synopsis of where we are and his insight of where the US and the rest of the world is heading was eerily similar to what I was seeing. His arguments are articulate and his analysis is rooted in history and economic theories. His solutions diverge from what I believe, but I am so encouraged that there are others out there putting the well thought out work into dissecting such a big topic as the deteriorating state of the world.

Wisate put out a post the other day on his Facebook that is worth highlighting. The realignment of the BRICS, in particular, the Russian and Chinese move away from the dollar for all oil purchases is a systemic shift in a system put together by Nixon and Kissinger. Here are some articles that back up Wisate’s theory (RUSSIA Gold, Russia/China Gold, Economic Times)

MARCH 26, 2018 … PetroDollar is beginning its journey back home. It is time to buy PHYSICAL GOLD & SILVER … hold it yourself. If you don’t hold it in your hands, it’s not yours.

Why is this date so important?

– China to FORMALLY announce Gold-backed Yuan and to use for oil/energy trading

– Russia is expected to leave SWIFT system completely as the alternative settlement system (away from the Western banking system) is now in place and tested. No more sanction/stealing money from countries by freezing their accounts. No more financial bully tactics can be imposed unfairly on countries. It is expected that up to 12 countries will switch to the new system within days. They now have the license to operate in UK and in Europe and Canada. Commodity exchanges around the world have also prepared for trading Yuan as well. As inflation in the US rises and the US dollar heads south, UK and its 2.4 billion subjects around the world will start dealing with PetroYuan instead. Inflation in the US will go up fast as all those printed PetroDollar comes back home.

Data shows that during the US great depression between 1929 and 1932, those who invested in the stock market at its peak lost 90% of their investment in 1932. Two thirds of people lost their jobs and those who still had their homes were living with high stress. The private construction industry in cities had a collapse rate over 80%. Many landlords saw their rental income drain away and went bankrupt. Suicide, sickness, hunger, murder (for money) spread throughout society. It is estimated that nearly 6% of the US population (7 million out of 123 million) died from malnutrition and nearly 2% from suicide.

* This will start slowly then once the trust in the new system is established, oil producing countries will start moving to PetroYuan since it is backed by gold. This is unlike PetroDollar which is backed by faith, weapons of war, and threats of destructions.

* The US has to sell about $250 billion in treasury in 1 month and new treasury of near $1.5 trillion this year. If no one wants USD in mass, no external buyers = more QE money printing (can’t really do it now neither if people are moving to Yuan because new QE will flood the market with more dollar in another attempt to keep interest low (buy more time) but this will result in even less buyer of the new US debt —> interest will have to go up to attract buyers… hint price of things will go up prior to the collapse which will take place once people lose trust in the currency OR no QE and let interest moves up …. as PetroDolar comes back home. TEvery 1% in interest moves up = $200 billion more per year to service debts (now that we have near $21 trillion in public debt). It is also expected that the home buying rate will be reduced by 10% for each 1% increased in rate. As the economic condition deteriorates = people and companies alike are to face difficulties and liquidate = price of real estate will start coming down = recession to depression. If the US defaults on debts then we will have hyperinflation => good for debtors (inflate your way out of debts) and pay off the debts with worthless money. This could bring the US to the Weimar Republic (currently Germany) situation real fast.

Together with more gold-backed Yuan becomes more preferred currency, things can go south real quick here in the US within few years. This process can happen quickly but I believe that within 3 years, things will look very different in the world finance than that of today. The western banking system is now in trapped in a sandbox. They did this to themselves by printing money (kicked the can down the road) instead of fixing the issue in 2008. For those who do not know, the level of debts (corporate and personal) has increased at the fastest rate since 2008. Thanks, but no thanks, to the world central banker: Feder the al Reserve for increasing its ledger by 4 times. Again, those who do not know, the current average reserve is not less than 5% (weight average of deposit, and money market and interbank lending which is also drying out worldwide now too and is a huge problem). What this means is the leverage of credit (create from the low reserve) is at least 20 times. In common term, we have created credit out of nothing in tune of near $80 trillions out of additional QEs of $4 trillion. Let say when the debts increase about 3 to 4 times faster than productivity during the same period, we have a big problem. Hint, corporations use cheap money (acquire more debts) and buyback its own stock, the price of the stock moves up. This is what we are seeing today in the stock market. P/E ratio of 12 to 14 used to be the norm for evaluation. Now the average P/E is 30 ….. Amazon, NetFlix and many high profile companies have P/E in hundreds. It is to note that when financial companies went south in 2008, the leverage ratio was around 40. That means 1 part equity and 39 parts in debt. Today the leverage ratio is around 70. Thanks to newly create cheap debts. But that is about to change once PetroYuan which is backed by gold gains traction.

What I expect to happen before then, is a lot of war speaking/threats/trade wars – high trariff or scrap previously made trade agreements around China/Russia area and political/small-scale wars around countries that are within China/Russia’s orbit, and countries with a lot of resources (oil, and minerals — North Korea and Afghanistan have trillions of UNMINED mineral as well, look it up). This is done to provoke war, world war. Many of grand-scale wars in the past took place at this junction, as it is the last move in the playbook to hold on to the influence by an impire. However, we now have an alternative. No war is needed. Life adjustment will be at the minimal worldwide.

Every countries can come out a winner but most, people around the world can all prosper together. Countries with a lot of debts will still grow but counries with less debts will have more room to grow faster. But that commerce (technology and knowledge) will flow from first world nations (heavy debts) to less developed nations (usually very low debt per capita). Hanomy Manifesto, free download at Hanomy.com, has a sounded solution for most of the problem we are facing (worldwide scale) in politic, social, and financial. A lots of “life normalcy” will be adjusted but at minimal going into Hanomy system. Numbers work, need the word to spread out to all the mass around the world. This is very exciting time to be alive, indeed.

Highlights of Hanomy:

• Fundamental human needs met throughout life’s existence

• Basic human rights observed everywhere

• Sovereign debts worldwide are settled and eliminated

• Upheld liberty and freedom

• Financial contributions drawn from a portion of idle/unutilized money

• No taxes on income, profit or spending

• Interest charges and usury practices abolished

• Power of money creation where it belongs – the people

• An end to the fractional reserve system

• Upheld free market principles (true capitalism but with social responsibility)

• Decreased or dissolved inflation and hyperinflation

• Reduced income inequality

• An end to corporate welfare

• Advanced technology benefiting humanity

• Freedom of time for quality of life and caregiving

• Prohibited conditions for authoritarianism

• Preserved sovereignty and respected borders

• An end to “modern day slavery” (this includes you)

• Improved care of the environment and world resources

• A world we’re proud to claim and pass along

Demise of cCapitalism (Theory) – Joseph Schumpeters

I’m hoping this guys theories aren’t a predictor of the future.

Wiki – Schumpeter’s most popular book in English is probably Capitalism, Socialism and Democracy. While he agrees with Karl Marx that capitalism will collapse and be replaced by socialism, Schumpeter predicts a different way this will come about. While Marx predicted that capitalism would be overthrown by a violent proletarian revolution, which actually occurred in the least capitalist countries, Schumpeter believed that capitalism would gradually weaken by itself and eventually collapse. Specifically, the success of capitalism would lead to corporatism and to values hostile to capitalism, especially among intellectuals. “Intellectuals” are a social class in a position to critique societal matters for which they are not directly responsible and to stand up for the interests of other classes. Intellectuals tend to have a negative outlook of capitalism, even while relying on it for prestige, because their professions rely on antagonism toward it. The growing number of people with higher education is a great advantage of capitalism, according to Schumpeter. Yet, unemployment and a lack of fulfilling work will cause intellectual critique, discontent and protests. Parliaments will increasingly elect social democratic parties, and democratic majorities will vote for restrictions on entrepreneurship. Increasing workers’ self-management, industrial democracy and regulatory institutions would evolve non-politically into “liberal capitalism”. Thus, the intellectual and social climate needed for thriving entrepreneurship will be replaced by some form of “laborism”. This will exacerbate “creative destruction” (a borrowed phrase to denote an endogenous replacement of old ways of doing things by new ways), which will ultimately undermine and destroy the capitalist structure.