Economics – Deep Thoughts on the ‘WHY?’ of the Human Condition

Economics

I love economics and how economic theories have advanced and declined over the generations. Perhaps one of my favorite communicators on an economic theory I subscribe to is Milton Friedman. Friedman’s 10 part series that that played a few decades ago. In the series, he weaves stories and is faced by a panel of peers that agree and disagree with his beliefs. He’s famous for many analogies but the pencil manufacturer is probably one of his most famous.

Friedman’s appearances on Phil Donahue, the Oprah of his time brought economics to the masses. His debates with Phil are very telling in Donahue’s leanings and how amazing Milton was as the art of debate:

Friedman’s 10 part series on PBS featured great stories, Milton’s philosophy and a debate panel of economic experts that are for and against his theories.

Friedman on the Road To Serfdom – HERE and Friedman vs Bernie – HERE

Where Friedman was at his best was during a college campus Q&A session. Here’s one of my favorites:

And Milton on what is America:

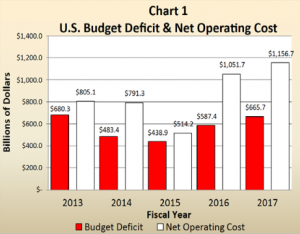

The debate of the last 100 years has been John Maynard Keynes and F.A. Hyack regarding their boom and bust cycles and the roll of government intervention in markets through interest rate manipulations. These two economic rap videos make it fun to learn the philosophies. Sadly, Keynes has dominated and $20 trillion later what do we have to show for it?

and part 2

Here’s a deeper dive into Keynes and Hayek.

I’m pretty contrarian on where we are as a county. The role of central banking in the last 45 years will be looked on as having major manipulations of markets. Between debt loads, crony capitalism, and easy money policies, we are so far removed from reality it scares me. This will not end well, the markets always correct itself.

Want to know how bad the problem really is? You can point to Detroit (probably one of my top 5 interviews), or Illinois, or New Jersey but nothing compares to what’s going on in Puerto Rico. This AEI panel discussion is long, about 2 hours, but the math surrounding the obligations of the tiny island will shock you. Whomever green light lending these kinds of dollars to this Country should get the haircut they deserve. Sadly, over promised public pensions and crippling debt may leave Puerto Rico with the only option of going hat and hand to Congress.

Want to know how bad the problem really is? You can point to Detroit (probably one of my top 5 interviews), or Illinois, or New Jersey but nothing compares to what’s going on in Puerto Rico. This AEI panel discussion is long, about 2 hours, but the math surrounding the obligations of the tiny island will shock you. Whomever green light lending these kinds of dollars to this Country should get the haircut they deserve. Sadly, over promised public pensions and crippling debt may leave Puerto Rico with the only option of going hat and hand to Congress.

Government Helping

Speaking of government warping markets. I’m not talking about health care or affordable housing, let’s take a look at higher education:

Spent the weekend up in Phoenix and all over the radio, on billboards and in print magazines I saw ads for the UofA MBA program……why? Hint, it’s where people can afford and can benefit from a Masters in Business.

In the past few years, tuition has increased, we’ve built a new stadium, a student gym/pool, hired two deans for diversity and inclusion, a social justice advocate (story picked up nationally as a snitch position).

Then from today’s Tucson paper:

The UA also opened a site in Cambodia last year and plans to launch 11 more as follows:

UA Amman at Princess Sumaya University of Technology, Jordan

UA Bandung at Telkom University, Indonesia

UA Beirut at Lebanese International University, Lebanon

UA Hanoi at Vietnam National University

UA Hualien City at Tzu Chi University of Science and Technology, Taiwan

UA Manila at De La Salle University, Philippines

UA Puebla at Universidad Popular Autónoma del Estado de Puebla, Mexico

UA Shanghai at Shanghai University of Politics and Law, China

UA Sharjah at the University of Sharjah, United Arab Emirates

UA Shenzhen at the Harbin Institute of Technology, China

UA Taipei at Soochow University, Taiwan

Tucson students with the means to travel would be able to take UA classes at any of the international sites.It is the 150th anniversary of the Morrill Land-Grant Act of 1862, which led to the establishment of public land-grant institutions including the UA.

I wonder if the UofA is sort of losing their mission to the scholars of Arizona. It’s an interesting debate but as ITT Tech and Univ of Phoenix get their hands slapped for being for profit, how is the UofA’s use of public/private funds to do all of the above a good thing?

Cant Escape The Market Forces

Some of the thought leaders that I seem to be agreeing with more and more include Richard Duncan. Here’s an interview he did with Gordon T Long:

Another contrarian that has actually been a major player in the Reagan administration that I follow is David Stockman.

Jeromy Grantham is the co-founder of GMO capital. His quarterly newsletter is a must read. Here he is with Charlie Rose:

Speaking of Contrarian –

Give a listen to Econo Talk’s interview with CATO’s David Boaz, and columnist/authors P.J. O’Rourke and George Will. Will make an interesting point about since the Great Depression there have been very small moments in time where liberals actually had control and a ‘mandate’ to govern. Those times started with FDR and a two year period where he attempted to pack the Supreme Court. LBJ and a two year period where the War on Poverty, Social Security, and Medicare came into existence and the 2008-2010 period under Barack Obama. During these brief two-year periods, major shifts to the left occur, the voters shift back to a center-right government and the laws enacted during those periods are extremely difficult to undo. Think Obamacare. Jump to 46:00 where Will takes down Academia. The panel talks about ‘Dictator for the Day Legislation’ and they weigh in on how to fix America. The ideas and suggestions include;

1. Get government totally out of K12.

2. End tax withholding. Make people write out their payroll withholding payment. By the way who is FICA?

3. Term limits or incumbents can’t stand for re-election if the government is in a deficit of more than 1% of GDP.

4. On all government deficits – all the taxpayers would be assessed on their tax form.

5. End of 1040 has tax payers fill in where they want their money to go…and have a line for ‘send my money back to me’.

6. I particularly like the idea of a balanced budget amendment passed by the States. I also like electing Senators from State Legislatures instead of by popular vote. Both of these ideas bring power back to the States.

Why are Libertarian ideas not taking root in the world? The answer is at the end of the podcast. Basically, it’s hard for people to accept that work, thrift and delayed gratification is good for you. That’s a tough political platform in this day of instant gratification.

This episode of EconTalk is being recorded in front of a live audience in Washington, D.C. in honor of the 40th Anniversary of the Cato Institute. Our topic is the past, present, and future of liberty. And to talk about it we have three special guests, David Boaz…, P. J. O’Rourke…, and George Will…. So, I want to start with the state of liberty in America. Is the glass half full or half empty? David, why don’t you lead us off?

Russ Roberts: I’m going to pile on. And I’ll let David and P.J. react accordingly if they wish. So, David, you pointed out marginal tax rates have come down, but government hasn’t gotten any smaller. Government continues to get larger. The nanny state continues to be more intrusive. Economics gets, as you say, the welfare state and various regulations–some have gone away. The cost of this is that everything that is bad about the current system is blamed on markets, even though it’s not a market process. So, the fact that United once dragged a passenger off a plane with Federal agents is an indictment of deregulation now. I’ve actually read things like that. Or that airline travel is so horrible because it’s just cheap. Or, the health care system proves that markets don’t work–when of course we’ve managed to remove almost every bit of market process that could be there to start with. So, on the facts I think it’s a tough argument that the glass is half full. Do you want to push back against that?

The Wealth of Nations – Adam Smith

I’m going to reference economic theories that I subscribe to, I would be remiss if I didn’t dig into the ideas of Adam Smith.

Economic Documentaries Worth A Watch

Here are some thought-provoking documentaries that line up on both sides of the political aisle. The common theme is the intersection of government, banking, and business

The common theme is the intersection of government, banking and business isn’t good for the economy and our future. I can take issue with individual arguments but the overarching themes are important to digest.

Overdose: The Next Financial Crisis

Requiem for the American Dream

EconoTalk with Russ Roberts

Another podcast I enjoy is EconoTalk with Russ Roberts. He and Tyler Cowen (to some degree Malcolm Gladwell and the team at Freakonomics) help take complex subjects, package them in palatable terms and deliver them to us listeners. This week, Russ interviewed Phillip Auerswald

Another podcast I enjoy is EconoTalk with Russ Roberts. He and Tyler Cowen (to some degree Malcolm Gladwell and the team at Freakonomics) help take complex subjects, package them in palatable terms and deliver them to us listeners. This week, Russ interviewed Phillip Auerswald

Give it a listen HERE

About 5 years into my 7-year radio career, after the 2012 election, I started noticing patterns that didn’t point in a positive direction with respect to the future of our Country.From 25 topics I’ve winnowed the list down to 12. I’m working on the outline of a book with a working title of the Dozen Trends that Spell the End of a Great Civilization. Philip Auerswald, hit chapters 3 (flight to the cities), 9 (demographics is destiny) and 11 (polarized political parties).

There is a lot of trade-offs with the 50-year migration from an agrarian and rural economy into the city, but there are also social ramifications that are right now being played out.

(Exert from my book) -The Decline of Rural America and Rise of The Blue Wave

As America moved from a rural, agricultural population and economy to what’s now densely populated urban megalopolises the entire fabric of America has changed. The small town I grew up in 40 miles east of Minneapolis is a perfect example of what’s happening all across America. New Richmond Wisconsin was once dominated by small dairy and beef farms. With a population of under 5,000, the area was settled by Irish and Norwegian immigrants. Large families, one stop light towns, a strong faith-centered community was the way I remembered my upbringing. My grandparents had a small farm with a butcher shop just outside of town. People would make the rounds to the baker, the butcher and spend an hour talking about the happenings of their families and their community. Our small town is now a bedroom community to the Twin Cities. The farmland has given way to housing tracts. In search of cheap housing and fueled by expanded interstates, the 40-minute drive to the jobs of Minneapolis is now a daily occurrence for thousands of workers. With the conversion of small family farms to master-planned neighborhoods, something is lost. The intimate understanding of your community and the ‘we are all in this together’ attitude that built America has given way to gated neighborhoods and walled off subdivisions.

Through the 1800’s cities like New York and Chicago were exemplified by immigrant neighborhoods, political machine politics, corruption, and exploitation. With the growth of megalopolis cities now almost in every state the same political machines have become much more sophisticated. The community I live in, Tucson Arizona and Pima County has been dominated by democratic machine politics for over 25 years. Once the machine is in place, they draw favorable electoral maps, they count and understand who votes and where. Patronage to favored developers, road contractors who in turn fund and underwrite political campaigns is the norm. The public sector unions understand that electing the right council or board of supervisors is good in the short run towards pay incentives and pension payouts. While property taxes, sales taxes, impact fees and regulations increase to pay for the bloated promises, the business class, job creators find the community unfriendly and difficult to do business in. Tucson has been compared to the Detroit of the Desert with flourishing suburbs and a decaying city core. There is always a push for revitalization or tax credits for favored industries in the name of spurring a resurgence to the inner city but these giveaways never see to last. Without a true level playing field with predictable rules and regulations my city, like hundreds around America have seen their tax base dwindle and their opportunities dissipate.

Political Machines

Political machines create an army of loyal professional bureaucrats. The bureaucracy knows to toe the party line. The politics of ‘no growth’ or ‘environmental activism’ or just plain old patronage takes root and it’s even harder to dislodge the culture of patronage once it’s established. At their worst, they just become a kleptocracy, too entrenched and handing out too many benefits to be uprooted. And the cost of maintaining the patronage system does real harm to the services the government should be providing.

This is not a victimless crime. Look at New York, where public unionized employees can make close to $100K a year + generous pension for jobs that would pay half that in the private sector. Great for those who have the jobs, but it means the city can’t fill the potholes or paint the subway stations. It’s not a handshake with a wad of cash, its unions getting cush contracts in return for mobilizing their workers at the ballot box. People should be paid fairly, with benefits, for work done, not given free money just for being part of a system.

Hanomy

I stumbled upon the ideas of (Han) Wisate based on a comment on an article. The comment leads to his web page Hanomy. Wisate’s synopsis of where we are and his insight of where the US and the rest of the world is heading was eerily similar to what I was seeing. His arguments are articulate and his analysis is rooted in history and economic theories. His solutions diverge from what I believe, but I am so encouraged that there are others out there putting the well thought out work into dissecting such a big topic as the deteriorating state of the world.

Wisate put out a post the other day on his Facebook that is worth highlighting. The realignment of the BRICS, in particular, the Russian and Chinese move away from the dollar for all oil purchases is a systemic shift in a system put together by Nixon and Kissinger. Here are some articles that back up Wisate’s theory (RUSSIA Gold, Russia/China Gold, Economic Times)

MARCH 26, 2018 … PetroDollar is beginning its journey back home. It is time to buy PHYSICAL GOLD & SILVER … hold it yourself. If you don’t hold it in your hands, it’s not yours.

Why is this date so important?

– China to FORMALLY announce Gold-backed Yuan and to use for oil/energy trading

– Russia is expected to leave SWIFT system completely as the alternative settlement system (away from the Western banking system) is now in place and tested. No more sanction/stealing money from countries by freezing their accounts. No more financial bully tactics can be imposed unfairly on countries. It is expected that up to 12 countries will switch to the new system within days. They now have the license to operate in UK and in Europe and Canada. Commodity exchanges around the world have also prepared for trading Yuan as well. As inflation in the US rises and the US dollar heads south, UK and its 2.4 billion subjects around the world will start dealing with PetroYuan instead. Inflation in the US will go up fast as all those printed PetroDollar comes back home.

Data shows that during the US great depression between 1929 and 1932, those who invested in the stock market at its peak lost 90% of their investment in 1932. Two thirds of people lost their jobs and those who still had their homes were living with high stress. The private construction industry in cities had a collapse rate over 80%. Many landlords saw their rental income drain away and went bankrupt. Suicide, sickness, hunger, murder (for money) spread throughout society. It is estimated that nearly 6% of the US population (7 million out of 123 million) died from malnutrition and nearly 2% from suicide.

* This will start slowly then once the trust in the new system is established, oil producing countries will start moving to PetroYuan since it is backed by gold. This is unlike PetroDollar which is backed by faith, weapons of war, and threats of destructions.

* The US has to sell about $250 billion in treasury in 1 month and new treasury of near $1.5 trillion this year. If no one wants USD in mass, no external buyers = more QE money printing (can’t really do it now neither if people are moving to Yuan because new QE will flood the market with more dollar in another attempt to keep interest low (buy more time) but this will result in even less buyer of the new US debt —> interest will have to go up to attract buyers… hint price of things will go up prior to the collapse which will take place once people lose trust in the currency OR no QE and let interest moves up …. as PetroDolar comes back home. TEvery 1% in interest moves up = $200 billion more per year to service debts (now that we have near $21 trillion in public debt). It is also expected that the home buying rate will be reduced by 10% for each 1% increased in rate. As the economic condition deteriorates = people and companies alike are to face difficulties and liquidate = price of real estate will start coming down = recession to depression. If the US defaults on debts then we will have hyperinflation => good for debtors (inflate your way out of debts) and pay off the debts with worthless money. This could bring the US to the Weimar Republic (currently Germany) situation real fast.

Together with more gold-backed Yuan becomes more preferred currency, things can go south real quick here in the US within few years. This process can happen quickly but I believe that within 3 years, things will look very different in the world finance than that of today. The western banking system is now in trapped in a sandbox. They did this to themselves by printing money (kicked the can down the road) instead of fixing the issue in 2008. For those who do not know, the level of debts (corporate and personal) has increased at the fastest rate since 2008. Thanks, but no thanks, to the world central banker: Feder the al Reserve for increasing its ledger by 4 times. Again, those who do not know, the current average reserve is not less than 5% (weight average of deposit, and money market and interbank lending which is also drying out worldwide now too and is a huge problem). What this means is the leverage of credit (create from the low reserve) is at least 20 times. In common term, we have created credit out of nothing in tune of near $80 trillions out of additional QEs of $4 trillion. Let say when the debts increase about 3 to 4 times faster than productivity during the same period, we have a big problem. Hint, corporations use cheap money (acquire more debts) and buyback its own stock, the price of the stock moves up. This is what we are seeing today in the stock market. P/E ratio of 12 to 14 used to be the norm for evaluation. Now the average P/E is 30 ….. Amazon, NetFlix and many high profile companies have P/E in hundreds. It is to note that when financial companies went south in 2008, the leverage ratio was around 40. That means 1 part equity and 39 parts in debt. Today the leverage ratio is around 70. Thanks to newly create cheap debts. But that is about to change once PetroYuan which is backed by gold gains traction.

What I expect to happen before then, is a lot of war speaking/threats/trade wars – high trariff or scrap previously made trade agreements around China/Russia area and political/small-scale wars around countries that are within China/Russia’s orbit, and countries with a lot of resources (oil, and minerals — North Korea and Afghanistan have trillions of UNMINED mineral as well, look it up). This is done to provoke war, world war. Many of grand-scale wars in the past took place at this junction, as it is the last move in the playbook to hold on to the influence by an impire. However, we now have an alternative. No war is needed. Life adjustment will be at the minimal worldwide.

Every countries can come out a winner but most, people around the world can all prosper together. Countries with a lot of debts will still grow but counries with less debts will have more room to grow faster. But that commerce (technology and knowledge) will flow from first world nations (heavy debts) to less developed nations (usually very low debt per capita). Hanomy Manifesto, free download at Hanomy.com, has a sounded solution for most of the problem we are facing (worldwide scale) in politic, social, and financial. A lots of “life normalcy” will be adjusted but at minimal going into Hanomy system. Numbers work, need the word to spread out to all the mass around the world. This is very exciting time to be alive, indeed.

Highlights of Hanomy:

• Fundamental human needs met throughout life’s existence

• Basic human rights observed everywhere

• Sovereign debts worldwide are settled and eliminated

• Upheld liberty and freedom

• Financial contributions drawn from a portion of idle/unutilized money

• No taxes on income, profit or spending

• Interest charges and usury practices abolished

• Power of money creation where it belongs – the people

• An end to the fractional reserve system

• Upheld free market principles (true capitalism but with social responsibility)

• Decreased or dissolved inflation and hyperinflation

• Reduced income inequality

• An end to corporate welfare

• Advanced technology benefiting humanity

• Freedom of time for quality of life and caregiving

• Prohibited conditions for authoritarianism

• Preserved sovereignty and respected borders

• An end to “modern day slavery” (this includes you)

• Improved care of the environment and world resources

• A world we’re proud to claim and pass along

Demise of cCapitalism (Theory) – Joseph Schumpeters

I’m hoping this guys theories aren’t a predictor of the future.

Wiki – Schumpeter’s most popular book in English is probably Capitalism, Socialism and Democracy. While he agrees with Karl Marx that capitalism will collapse and be replaced by socialism, Schumpeter predicts a different way this will come about. While Marx predicted that capitalism would be overthrown by a violent proletarian revolution, which actually occurred in the least capitalist countries, Schumpeter believed that capitalism would gradually weaken by itself and eventually collapse. Specifically, the success of capitalism would lead to corporatism and to values hostile to capitalism, especially among intellectuals. “Intellectuals” are a social class in a position to critique societal matters for which they are not directly responsible and to stand up for the interests of other classes. Intellectuals tend to have a negative outlook of capitalism, even while relying on it for prestige, because their professions rely on antagonism toward it. The growing number of people with higher education is a great advantage of capitalism, according to Schumpeter. Yet, unemployment and a lack of fulfilling work will cause intellectual critique, discontent and protests. Parliaments will increasingly elect social democratic parties, and democratic majorities will vote for restrictions on entrepreneurship. Increasing workers’ self-management, industrial democracy and regulatory institutions would evolve non-politically into “liberal capitalism”. Thus, the intellectual and social climate needed for thriving entrepreneurship will be replaced by some form of “laborism”. This will exacerbate “creative destruction” (a borrowed phrase to denote an endogenous replacement of old ways of doing things by new ways), which will ultimately undermine and destroy the capitalist structure.

Wiki – Schumpeter’s most popular book in English is probably Capitalism, Socialism and Democracy. While he agrees with Karl Marx that capitalism will collapse and be replaced by socialism, Schumpeter predicts a different way this will come about. While Marx predicted that capitalism would be overthrown by a violent proletarian revolution, which actually occurred in the least capitalist countries, Schumpeter believed that capitalism would gradually weaken by itself and eventually collapse. Specifically, the success of capitalism would lead to corporatism and to values hostile to capitalism, especially among intellectuals. “Intellectuals” are a social class in a position to critique societal matters for which they are not directly responsible and to stand up for the interests of other classes. Intellectuals tend to have a negative outlook of capitalism, even while relying on it for prestige, because their professions rely on antagonism toward it. The growing number of people with higher education is a great advantage of capitalism, according to Schumpeter. Yet, unemployment and a lack of fulfilling work will cause intellectual critique, discontent and protests. Parliaments will increasingly elect social democratic parties, and democratic majorities will vote for restrictions on entrepreneurship. Increasing workers’ self-management, industrial democracy and regulatory institutions would evolve non-politically into “liberal capitalism”. Thus, the intellectual and social climate needed for thriving entrepreneurship will be replaced by some form of “laborism”. This will exacerbate “creative destruction” (a borrowed phrase to denote an endogenous replacement of old ways of doing things by new ways), which will ultimately undermine and destroy the capitalist structure.

Schumpeter emphasizes throughout this book that he is analyzing trends, not engaging in political advocacy.[32]

Innovation

Schumpeter identified innovation as the critical dimension of economic change.[39] He argued that economic change revolves around innovation, entrepreneurial activities, and market power. He sought to prove that innovation-originated market power can provide better results than the invisible hand and price competition. He argued that technological innovation often creates temporary monopolies, allowing abnormal profits that would soon be competed away by rivals and imitators. These temporary monopolies were necessary to provide the incentive for firms to develop new products and processes.[39]

Tyler Cowin – Marginal Revolution (one of my favorite contemporary economists -Blog – HERE – Open Courses – HERE – Podcast HERE) covers Schumpeter – HERE

The Trees – Getty Lee

There is unrest in the forest

There is trouble with the trees

For the maples want more sunlight

And the oaks ignore their pleasThe trouble with the maples

And they’re quite convinced they’re right

They say the oaks are just too lofty

And they grab up all the light

But the oaks can’t help their feelings

If they like the way they’re made

And they wonder why the maples

Can’t be happy in their shade?There is trouble in the forest

And the creatures all have fled

As the maples scream ‘oppression!’

And the oaks, just shake their headsSo the maples formed a union

And demanded equal rights

‘The oaks are just too greedy

We will make them give us light’

Now there’s no more oak oppression

For they passed a noble lawAnd the trees are all kept equal

By hatchet,

Axe,

And saw

Yale Open Courses

The study of economics fascinates me because it wraps up the core of human nature and sprinkles in how societies organize (sociology) and how societies chose to govern themselves (politics). This lecture series on Schumpeter and Marx by Yale’s Professor Rae is worth a watch. Technology and innovation has shown to change markets and societies for generations. America is based on this creative destruction idea, and just when you think we are at our darkest moment (Civil War, Great Depression, Cuban Missle Crisis, Watergate) we find a way to pull a rabbit out of the hat and re-tool our economy and society. I’m crafting 12 arguments that point to a demise of the American experience. Can we creatively destroy and rebuild? Marx has been proven wrong and Schumpter’s theories on intellectuals and the interests of the corporation have bent our country but not broken it.

PLSC 270: Capitalism: Success, Crisis, and Reform -Lecture 4 – Karl Marx, Joseph Schumpeter, and an Economic System Incapable of Coming to Rest

Professor Rae relates Marxist theories of monopoly capitalism to Schumpeter’s theory of creative destruction. Both Marx and Schumpeter agree that capitalism is a system that is “incapable of standing still,” and is always revising (or revolutionizing) itself. Professor Rae critiques Marxist determinism and other features of Marx’s theories. To highlight Schumpeterian creative destruction, Professor Rae uses examples from technological revolutions in energy production since water-powered mills. Marx’s labor theory of value is discussed. Professor Rae highlights aspects overlooked by Marx, including supply and demand for labor, labor quality, and the role of capital in economic growth. Professor Rae also notes problems with Marx’s predictions, including the prediction that the revolution will occur in the most advanced capitalist economies. Professor Rae also discusses Marx’s theory of the universal class, the end of exploitation, and the withering away of the state. – Lecture 5 is continued HERE.